Nature Of Business

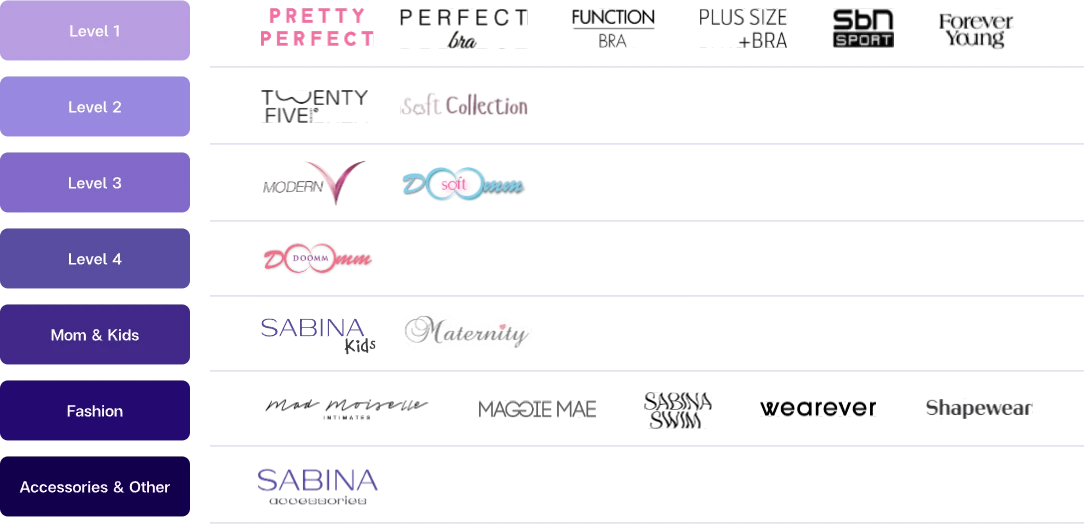

The products vary in prices to fit with different target groups.

The lowest price products are distributed through modern trade, such as BigC and Tesco Lotus. The middle price products, which cost about 700-800 Baht, are distributed throughout the country, including Doomm Series, Wireless bras, and Modern V. For the top price products under the brand Madmoiselle, Maggiemae and Cris’s Collection, which cost over 1,000 Baht, are only distributed in big cities and in Bangkok area only.

Sabina's Characteristic

SABINA's characteristic is not only fashionable but also functional. The outside of the product is well-designed with lace and beautiful stuff, while the inside is well-tailored with good pattern to be able to fit with different body type of women.

For example, DoommDoomm series are made with different support sponges that are placed in certain places to get the desired shape for women. The company emphasizes on the importance of the patterns on each collection to suit with various body type, to create the best desired shape for customers, from small sizes to large sizes, with the selected fabric and pattern to support different shape of chests.

From OEM Manufacturer To Brand Developer

At the same time, the company has adjusted its business goals since 2007 by keep reducing the proportion of OEM products sales and proportion of Sabina brand sales in the country.

Until the last year 2025, the proportion of OEM products sales is 9% and the proportion of Sabina brand sales is 91% of the total income according to the consolidated financial statements but the company still hold the maintaining proportion of OEM products policy to be in the level of not more than 10 - 20 percent of the production capacity.

Revenue Breakdown

Sabina Brand

- Sale of offline 2025 has decrease 13.8% , which is in line with the market trend.

- The launch of Unisex and men’s underwear products in 2025 marks an important expansion opportunity for the brand beyond its traditional women’s lingerie segment. The initial market response has been encouraging, reflecting potential for growth in this new customer segment.

- The company continues to invest in the expansion of its retail network, focusing on high-potential locations with strong sales prospects. It is expected that at least 10 new stores will be opened from 2026 onward. In addition, new sales channels may be introduced in 2026.

NSR

- Online Business continues to deliver solid growth and remains the channel with the highest consumer spending, while maintaining its position as the number one brand across all platform campaigns.

- TV & Catalog channels have experienced a decline in growth, reflecting a shift in consumer purchasing behavior toward online platforms.

- New Business continues to grow consistently, supported by demand from both end-consumers and resellers.

OEM

- FY2025 revenue totaled THB 295.9 million, representing 50% YoY growth and exceeding target by more than 30%, supported by the company’s appointment as a primary supplier to a key client.

- Looking ahead to 2026, the company remains focused on maintaining product quality and delivery standards, while continuing to prioritize sustainability-a critical consideration for customers. Ongoing commitment in these areas will be essential to strengthening customer confidence, attracting new clients, and ensuring sustainable long-term growth.